Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. An investor should understand these and additional risks before trading. Carefully consider the investment objectives, risks, charges and expenses before investing.

All investments involve risk and losses may exceed the principal invested. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. By and large, market capitalization calibrates the value of a publicly traded company on global financial markets. It also shows the stock market's outlook on a given company's prospects.

Market cap tells you how much money investors are willing to pay for shares of a company's stock. On August 13, 2020, Epic Games, the maker of the popular game Fortnite, sued Apple and Google after its hugely popular video game was removed from Apple and Google's App Store. The suits come after both Apple and Google blocked the game after it introduced a direct payment system, effectively shutting out the tech titans from collecting fees. In September 2020 Epic Games founded the Coalition for App Fairness together with other thirteen companies, which aims for better conditions for the inclusion of apps in the app stores. Later in December 2020, Facebook agreed to assist Epic in their legal game against Apple, planning to support the company by providing materials and documents to Epic.

Facebook had, however, stated that the company will not participate directly with the lawsuit, although did commit to helping with the discovery of evidence relating to the trial of 2021. In the months prior to their agreement, Facebook had been dealing with feuds against Apple relating to the prices of paid apps as well as privacy rule changes. Savvy stock market investors kick many tires when sizing up a stock. They look at market capitalization, income, profits, quality of leadership, and dividend rate. But in the end, the true measure of a publicly traded security is its stock price. One of the golden rules of the stock market is that you cannot be impatient.

It is all about patience, and if you have that, sky is the limit. This holds true for equity investors who invested in MRF shares in April 1993 and held on. MRF , which debuted as a public company with a face value of Rs 10 per share, has delivered more than 7,40,109 per cent returns to investors in the last 25 years. On April 27, 1993, the company's share closed at Rs 11 compared to the current price of Rs 54,488 on BSE. While its share price cements Berkshire Hathaway's status as the most expensive stock trading these days, it's not the largest by market capitalization.

You can figure out market cap by multiplying the total number of shares by the present share price. Tata Consultancy Services has announced a buyback valued at Rs 18,000 crore at Rs 4,500 per share. The buyback price is at a premium of 16.7 per cent over the today's closing price of the stock. In today's trade, Tata Consultancy Services share price ended 1.5 per cent down at Rs 3,857.25 apiece.

The board of directors of the company has approved to repurchase up to 4 crore shares. The IT bellwether has posted a net profit of Rs 9,769 crore in the fiscal third quarter, as compared to Rs 9,624 crore in the previous quarter. Has always been a strong and innovative company with a history of successful product launches.

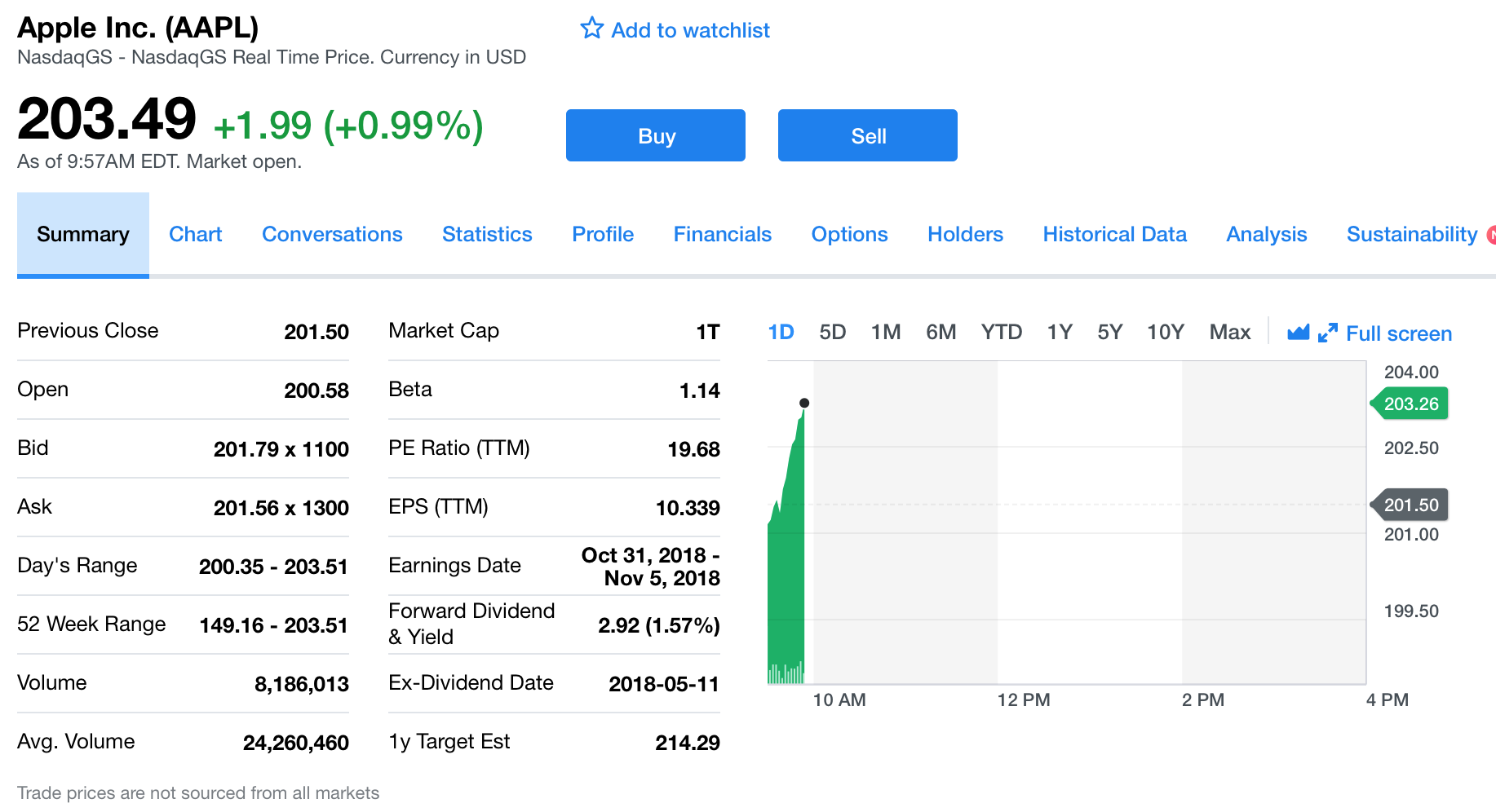

Apple has come under attack by several investors citing concerns with the company's share price. Now I'm not predicting that Apple will reach $10,000 anytime soon; I'm trying to open up your mind and bust a long-time investment myth. Many investors are calling the top of Apple purely because the company failed to break its high of over $426 share. They say, how high can Apple go now that its at over $360 a share? A stock's share price has nothing to do with how high or low a stock can go. In fact, the share price is determined by the investors in the stock and the performance of the company itself.

Berkshire started trading in 1979 at $775 per share, and the company now trades at over $110,000 a share. All the company did was continue its history of successfully growing its business and generating profits. The company is attempting to woo investors with a high dividend payment.

Some companies try to give their stock prices a boost by increasing the dividend to attract new investors. Impressed by the high dividend yield, some investors may buy shares, driving up the stock price. But this dividend payout—and increased stock value—may not last if the company isn't financially stable and can't afford to maintain the higher dividend payments. By the end of the 1970s, Apple had a staff of computer designers and a production line. The company introduced the Apple III in May 1980 in an attempt to compete with IBM in the business and corporate computing market.

Jobs and several Apple employees, including human–computer interface expert Jef Raskin, visited Xerox PARC in December 1979 to see a demonstration of the Xerox Alto. Xerox granted Apple engineers three days of access to the PARC facilities in return for the option to buy 100,000 shares (5.6 million split-adjusted shares as of March 30, 2019) of Apple at the pre-IPO price of $10 a share. Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Buying stocks to hold and grow your savings over the long term i.e. 5 years and beyond. Time invested not timing matters, the longer you can give your investments to grow the better Timing is crucial, but consistently buying low and selling high isn't something many can achieve.

Like any investment, the value of your investments can go down as well as up, so you may get back less than what you invest. Investing for the long term makes you less sensitive to leaves movements though. Dipping in and out of the market will likely hurt your investment returns. You might miss the worst days but you'll also miss the best days. Investing is one of the best ways to grow your savings over the long term. Constantly making short term decisions is likely to come at the cost of your long-term investing goals.

The term par value can be misleading because it has nothing to do with how much a corporation's shares are actually worth. A corporation's board of directors may require investors to pay far more than par value for the corporations' shares. For example, you can establish a par value of $.01 per share, but require investors to pay $10 per share. In other words, you can sell your stock for whatever the market will bear. If your incorporated business proves successful, your shares should become worth far more than their par value.

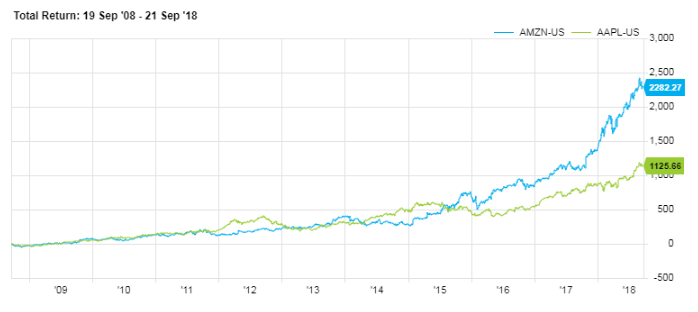

Berkshire Hathaway first bought Visa in the third quarter of 2011, and it has proven to be a mammoth winner. Including dividends, Visa has delivered a whopping total return of 964%, well more than double the S&P 500's 407% total return in that time. Visa also is a dividend-growth machine, ramping up its payout by 127% over the past five years alone. I have been investing in the markets for the last 10 years in a way that I'm able to take advantage of the various moves the market makes through different economic cycles. In periods of Volatility I will take trades that would last several days or weeks and during periods of strong trends I will take core positions that could last several months.

I trade all asset classes and believe in today's markets you have to be nimble. You have to be able to deploy capital into the correct strategies and asset classes that could provide you with the best returns at that time. I am an independent trader that formerly worked for Wells Fargo.

I currently own several wireless and fast food businesses in the United States. I invest as part of my passion and to continuously educate myself and others. I believe in educating new investors in how to properly invest in the market and I believe there is more than one correct strategy. When I was first starting out I was looking for the one way to make money in the markets and what I found was there were several ways to make money in the markets. It is more about finding the right strategy that would fit the investor's personality than finding the right strategy.

I'm bullish on Apple and have no concerns regarding the company's share price or future. The market may challenge previous lows, which should give investors an opportunity to buy Apple much cheaper. Apple has had a successful track record of continuously generating profits, and I expect that to continue.

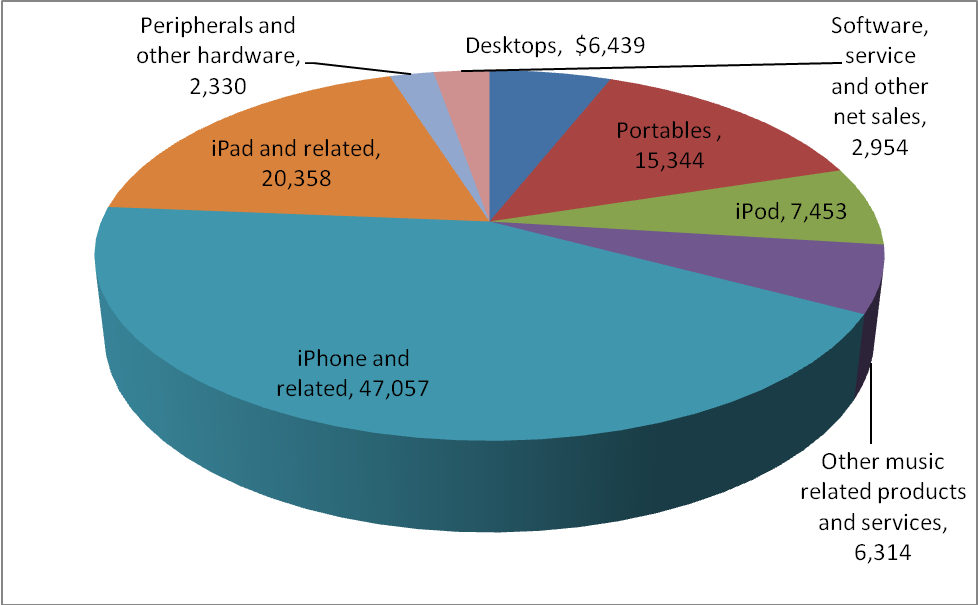

At current prices, the market is discounting the future pipeline of the company. Apple has done an amazing job of building its brand to a point that many consumers purchase every launch of its products; the iPad and iPhone lines are good examples of this. With expectations of additional product launches next year, I don't see any reason why Apple can't get above the $426 mark and go much higher. In the first quarter of 2014, Apple reported sales of 51 million iPhones and 26 million iPads, becoming all-time quarterly sales records. It also experienced a significant year-over-year increase in Mac sales.

Iovine believed that Beats had always "belonged" with Apple, as the company modeled itself after Apple's "unmatched ability to marry culture and technology." The acquisition was the largest purchase in Apple's history. Around 1998 Apple completed numerous acquisitions to create a portfolio of digital production software for both professionals and consumers. Of these, one notable transaction was Apple's acquisition of Macromedia's Key Grip software project, signaling an expansion into the digital video editing market. The sale was an outcome of Macromedia's decision to solely focus on web development software. The product, still unfinished at the time of the sale, was renamed "Final Cut Pro" when it was launched on the retail market in April 1999. The development of Key Grip also led to Apple's release of the consumer video-editing product iMovie in October 1999.

Next, Apple successfully acquired the German company Astarte, which had developed DVD authoring technology, as well as Astarte's corresponding products and engineering team in April 2000. Astarte's digital tool DVDirector was subsequently transformed into the professional-oriented DVD Studio Pro software product. Apple then employed the same technology to create iDVD for the consumer market. In July 2001, Apple acquired Spruce Technologies, a PC DVD authoring platform, to incorporate their technology into Apple's expanding portfolio of digital video projects.

As the market for personal computers expanded and evolved throughout the 1990s, Apple lost considerable market share to the lower-priced duopoly of Microsoft Windows on Intel PC clones. The board recruited CEO Gil Amelio, who prepared the struggling company for eventual success with extensive reforms, product focus and layoffs in his 500-day tenure. In 1997, Amelio bought NeXT to resolve Apple's unsuccessful operating-system strategy and entice Jobs back to the company; he replaced Amelio. First, a revitalizing campaign called "Think different", and by launching the iMac and iPod.

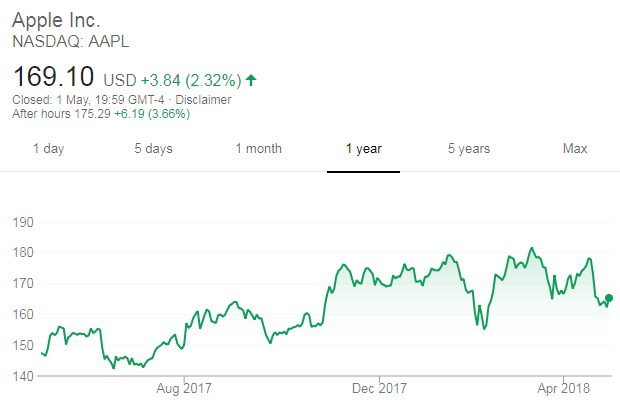

In 2001, it opened a retail chain, the Apple Stores, and has acquired numerous companies to broaden its software portfolio. In 2007, the company launched the iPhone to critical acclaim and financial success. Jobs resigned in 2011 for health reasons, and died two months later. Apple Inc. is a global technology company that designs, manufactures, and sells smartphones, personal computers, tablets, wearables, and accessories. While it certainly would have been wonderful to acquire Apple stock for just a little over $20 a share in hindsight, that doesn't mean the stock isn't now also worth buying at a just under $200 a share. Apple's financials look strong across the board, and the company has more than established its ability to introduce quality products and win in the marketplace.

Therefore, investors may do well to consider buying Apple for future returns on investment. But by the end of 2002, the stock price declined to $14.33 a share, which represented an approximately 40% loss in the hypothetical $100 stock purchase made at the start of the year. By the end of 2004, Apple's stock price climbed to $64.40 per share, making an original four share investment worth $257.60. Apple first paid a dividend in 1987, but financial trouble caused the company to suspend dividend payouts in 1995.

After selling millions of iPods, iPhones, and iPads, and raking in billions in profits, Apple reinstated the dividend in 2012. The company currently distributes a quarterly payout of $0.77 per share. With 254 shares, you would be earning $782 every year in dividend income -- a nice return on an original investment of just $100. That substantially reduced Apple's dependence on the iPhone — and propelled the company's share price to a level where its price-to-earnings ratio is now three times higher than what it was a decade ago. As of Q1 2021, the contracted pipeline sits at 85 GW, with most of those projects slated for completion before 2024, ahead of the previously scheduled step-downs for the Investment Tax Credit .

Even after its Q4 share sales, the tech giant still represents more than 40% of assets in the Berkshire Hathaway equity portfolio. And Berkshire remains Apple's third largest investor with an 887 million-share stake representing about 5.4% of all shares outstanding. Only Vanguard and BlackRock – giants of the passively managed index fund universe – hold more Apple stock.

The tiny position did hold up well during the bear market, as investors added some consumer staples stocks for defense. But MDLZ has put up more modest returns since stocks got back into gear. All told, Mondelez shares are up just 10% since the Feb. 19, 2020, market top, while the S&P 500 has delivered more than 42% in total returns. Berkshire isn't even among Mondelez's top 100 shareholders, at just 0.04% of MDLZ shares outstanding, according to data from S&P Global Market Intelligence. And Mondelez is a nothingburger among Buffett stocks, accounting for just 1/100th of a percent of the total value of BRK.B's equity portfolio.

How Much Would 10000 Shares Of Apple Be Worth Following the example mentioned when introducing the initial margin requirement, the current price of stock ABC is $100. You now have 100 shares of stock ABC bought using $5,000 in cash and $5,000 on margin. If a stock has seen a dramatic price decline and its dividend hasn't been cut yet, the yield can appear high. Consider a company that pays a $2 annual dividend per share with a stock price of $60. If its price falls to $20, its dividend yield almost triples to about 10%.

This yield might look really favorable at first glance, but on deeper examination it actually signals that the company is in trouble because its share price has dropped sharply. This means that a dividend reduction or elimination may follow soon. In its fiscal year ending in September 2011, Apple Inc. reported a total of $108 billion in annual revenues—a significant increase from its 2010 revenues of $65 billion—and nearly $82 billion in cash reserves. On March 19, 2012, Apple announced plans for a $2.65-per-share dividend beginning in fourth quarter of 2012, per approval by their board of directors. During an event on March 21, 2016, Apple provided a status update on its environmental initiative to be 100% renewable in all of its worldwide operations. Apple working in partnership with Conservation Fund, have preserved 36,000 acres of working forests in Maine and North Carolina.

Another partnership announced is with the World Wildlife Fund to preserve up to 1,000,000 acres of forests in China. This installation alone compensates for more than all of the energy used in Apple's Stores and Offices in the whole of China, negating the company's energy carbon footprint in the country. In Singapore, Apple has worked with the Singaporean government to cover the rooftops of 800 buildings in the city-state with solar panels allowing Apple's Singapore operations to be run on 100% renewable energy.

Liam was introduced to the world, an advanced robotic disassembler and sorter designed by Apple Engineers in California specifically for recycling outdated or broken iPhones. At Apple, employees are intended to be specialists who are not exposed to functions outside their area of expertise. Jobs saw this as a means of having "best-in-class" employees in every role. For instance, Ron Johnson—Senior Vice President of Retail Operations until November 1, 2011—was responsible for site selection, in-store service, and store layout, yet had no control of the inventory in his stores.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.